Review Summary

You can review the entered cashflow funds for each of the selected currencies and the horizon on the page.

At the top of the page, the exchange rate![]() The rate at which one currency will be exchanged for another currency. against the base currency

The rate at which one currency will be exchanged for another currency. against the base currency![]() Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. is displayed for all the selected currencies.

Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. is displayed for all the selected currencies.

Note: If you have modified the exchange rate, your custom budget rate is displayed here.

By default, the toggle is turned OFF and the page displays a cumulative view of the entered cashflow transactions. To switch to an individual currency view, toggle .

Note: In the cumulative view, the , , , and the tables will only display the column and the row. The base currency row will show the total value of the entered currencies converted to the base currency using the exchange rate displayed at the top of the page. If the toggle is turned ON the following information is displayed in the tables:

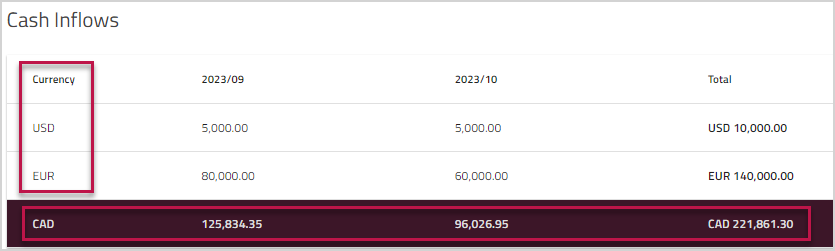

Cash Inflows and Cash Outflows

In the and table, the amount entered for each currency will be shown as a separate line item in the table for the selected horizon. The column will display the total for each currency. The base currency row will show the total value of the entered currencies after converting them to the base currency using the exchange rate displayed at the top of the page.

Cash Inflows and Cash Outflows

For example, if your base currency is CAD, and you've selected USD and EUR as the currencies for your cashflow, each row in the table will display the entered value for the corresponding currency. The system will then convert the entered FX currency values using the exchange rate shown at the top of the page and show the total amount in the base currency row (CAD).

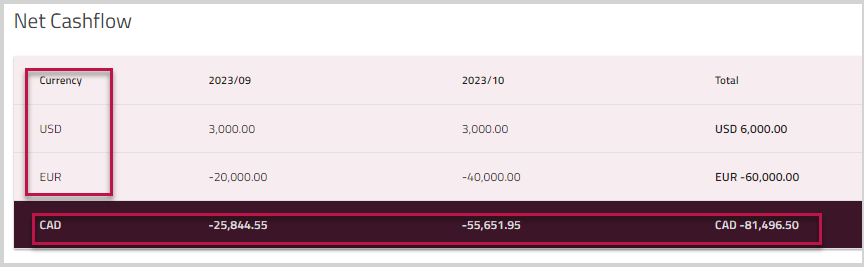

Net Cashflow

The net amount entered for each currency will be shown as a separate line item in the table. The column will display the net total for each currency. The base currency row will show the total net value of all the entered currencies converted to the base currency.

Note: The table is also displayed if the selected is . The net amount for each currency is calculated by subtracting the cash outflow from cash inflow.

Net Cashflow

For example, if your base currency is CAD, and you've selected USD and EUR as the currencies for your cashflow, each row in the table will show the net value for the corresponding currency. The system will then convert the entered FX currency values using the exchange rate shown at the top of the page and and show the total net amount in the base currency row (CAD).

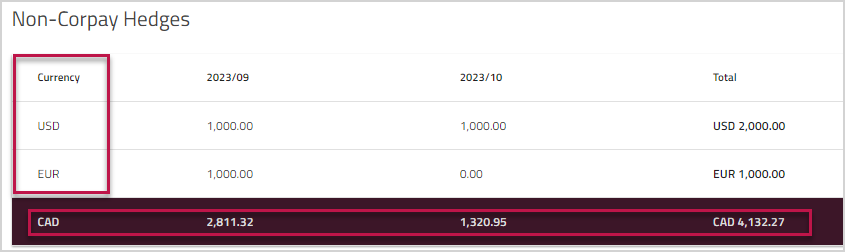

Non-Corpay Hedges

In the table, the amount entered for each currency will be shown as a separate line item in the table. The column will display the total for each currency. The base currency row will show the total value of the entered currencies converted to the base currency using the exchange rate displayed at the top of the page.

Non-Corpay Hedges

For example, if your base currency is CAD, and you've selected USD and EUR as the currencies for your cashflow, each row in the table will show the total value for the entered currency. The system will then convert the entered FX currency values using the exchange rate shown at the top of the page and and show the total amount in the base currency row (CAD).

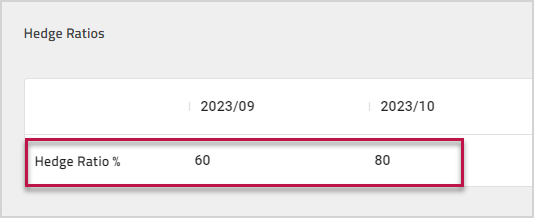

Hedge Ratios

In this table, you can set the percentage of your cashflow that you want to hedge against potential FX risks. This will enable you to manage and mitigate the risks associated with the fluctuations in the exchange rate. By default, the is set to 60. You can review and adjust the percentage as required for your cashflow. Enter your preferred for the selected horizon. The entered value is saved when you click .

:

-

You can enter a value between 0-100 (both inclusive). You cannot exceed 100.

-

You cannot enter a decimal or an invalid number. If you attempt to add a decimal number the system will round it to the nearest integer.

Click to edit the cashflow information entered on the Enter Cashflow Transactions page.

Important: Modifying data on the cashflow transactions page will impact the calculated values on this page.

Click to view the Risk Exposure Summary for your cashflow.

Note: Client represents and warrants that they are only inputting data they have the right to process. Client acknowledges that they are solely responsible for the quality, reliability, and accuracy of all data they enter, as well as any reports generated from that data.